McKinsey Valuation: (7th Edition)

This is a book about valuation. Despite that, I found that it contains many valuable insights on what makes businesses great and what metrics to look out for. This post will focus on the latter and will be delivered in a summarized manner.

If you’d like to read more, here’s the link to the E-Book.

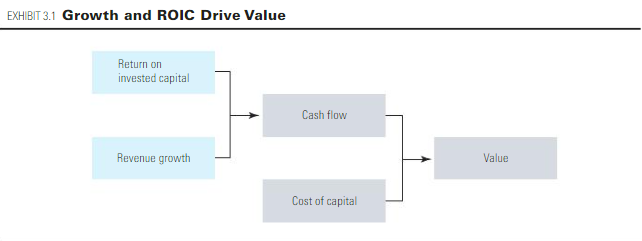

Fundamentals of Value Creation

Companies that grow revenue and earn a return on capital that exceeds their cost of capital create value. Hence, the amount of value a company creates is governed by its

ROIC

Revenue growth

Ability to sustain both over time.

VALUE DRIVER #1 - ROIC

WHAT CAN WE SAY ABOUT A COMPANY ABLE TO SUSTAIN HIGH ROIC?

They have a Sustainable Competitive Advantage.

And a great Business Strategy.

DOES ROIC REVERT TO THE MEAN?

No. Companies with high ROIC tend to stay high while companies with low ROIC tend to stay low. If a company finds a formula or strategy that earns an attractive ROIC, there is a good chance it can sustain that attractive return over time and through changing economic, industry, and company conditions, especially in the case of industries that enjoy relatively long product life cycles. Of course, the converse also is true: if a company earns a low ROIC, that is likely to persist as well.

This reminds me of David Gardner’s teaching:

“Winners keep on winning”

HOW WILL LIONVESTOR USE ROIC TO MAKE INVESTMENT CHOICES?

I prefer to choose companies that have ROIC (no shit sherlock) but only on the assumption that past success is indicative of future success. ROIC only tells us how well management has been allocating capital up till that point in time and is not a sure-fire thing that they will continue to achieve similar ROIC(s) on their future investments.

On top of ROIC, we must also consider the future of the company and how management plans to allocate capital.

Questions to evaluate the Future of the company:

What new products/services are they launching?

What new markets are they entering?

How successful do you think they’ll be given their current track record?

Questions to evaluate the Capital Allocation abilities of the company:

M&A - Are they making smart acquisitions and able to integrate the acquired company well? Does the new acquisition make strategic business sense?

Stock Buybacks - Are they able to identify when stock prices are low and make a buyback?

Pay-off Debt - Are they paying off high-interest debts?

R&D + S&M - This is my favorite kind of capital allocation as it uses pre-tax dollars to grow and strengthen the business.

There’s a metric (ROIIC) to measure how effectively a company allocates capital which you can read more about here.

WHICH INDUSTRIES TEND TO HAVE HIGH ROIC?

INDUSTRIES WITH PERSISTENTLY HIGH ROIC

Information Services & Software

Pharmaceuticals

Beverages

Household & Personal Products

INDUSTRIES WITH ROIC TRENDING UP

Health-care Equipment

Aerospace & Defense

Airlines

Biotechnology

Technology Hardware

VALUE DRIVER #2 - REVENUE GROWTH

DRIVERS OF REVENUE GROWTH (Ranked in order of importance)

Portfolio momentum i.e. Optionality. This is the organic revenue growth from launching new products/services and creating new customer segments. These kinds of moves typically result in an increased Total Addressable Market (TAM).

Mergers and acquisitions (M&A). This represents the inorganic growth a company achieves when it buys or sells revenues through acquisitions or divestments.

Market share performance. Organic revenue growth by gaining market share in existing markets.

PORTFOLIO MOMENTUM - THE #1 DRIVER OF GROWTH

For large companies, the most important and sustainable source of growth is Portfolio momentum.

i.e. Expanding its Total Addressable Market (TAM) by launching new products/services (P&S) and entering new markets, especially fast-growing ones.

These P&S(s) are usually so innovative that it creates entirely new product categories, and they possess the highest value-creating potential. The stronger the competitive advantage a company can establish in the new product category, the higher it’s ROIC and the value created will be.

P&S innovation aside, companies can also convince existing customers to buy more OR attract new customers to the market, OR both.

SUSTAINING GROWTH

Sustaining high growth presents major challenges to companies. Given the natural life cycle of products, the only way to achieve consistently high growth is to consistently find new product markets and enter them successfully in time to enjoy their more profitable high-growth phase.

In my “100X” post, one of the criteria was OPTIONALITY. It is also one key characteristic David Gardner looks for:

“A company with infinite possible futures.”

ESG

Note: As with most score-based systems, companies will try to “game” the system and artificially push up their ESG scores. Therefore, I caution readers to carefully evaluate companies and not just look at their ESG scores.

MAJOR BENEFITS OF ESG, ACCORDING TO A 2019 SURVEY OF 558 EXECUTIVES.

A good reputation and brand equity

Attracting and maintaining talented employees

Strengthening the company’s competitive position.

Respondents are willing to pay a 10% premium for companies with a +ve ESG record.

MORE BENEFITS OF ESG:

Revenue Growth

A strong ESG proposition helps companies tap new markets and expand in existing ones. When governing authorities trust corporate actors, they are more likely to award them the access, approvals, and licenses that afford fresh opportunities for growth.

ESG can also drive consumer preference. McKinsey's research has shown that customers say they are willing to pay to “go green.” Upward of 70 percent said they would pay an additional 5 percent for a green product if it met the same performance standards as a nongreen alternative.

Cost Reductions

Consider 3M. Since introducing the “pollution prevention pays,” program in 1975, 3M has saved $2.2 billion. This program aims to prevent rather than clean up pollution; efforts have included reformulating products, improving manufacturing processes, redesigning equipment, and recycling and reusing waste from production.

Reduced Regulatory and Legal Interventions

The value at stake may be higher than you think. Typically 1/3 of corporate profits are at risk from state intervention.

Regulation’s impact on profits varies by industry:

Pharmaceuticals / Health care - 25 to 30%.

Banking - 50 to 60%

Automotive, aerospace and defense, and tech sectors - up to 60%

Note: Government subsidies (among other forms of intervention) are prevalent in these sectors.

Employee Productivity Uplift

A strong ESG proposition can help companies attract and retain quality employees, enhance employee motivation by instilling a sense of purpose, and increase productivity overall. Employee satisfaction is positively correlated with shareholder returns.

London Business School’s Alex Edmans found that the companies that made Fortune’s list of the 100 Best Companies to Work For in America generated 2.3 - 3.8% higher stock returns per year than their peers, measured over a period of more than 25 years.

Farsighted companies pay heed. Consider General Mills, which works to ensure that its ESG principles apply “from farm to fork to landll.” Walmart, for its part, tracks the work conditions of its suppliers, including those with extensive factory floors in China, according to a proprietary company scorecard. And Mars seeks opportunities where it can deliver what it calls “win-win-wins” for the company, its suppliers, and the environment.

“Win-Win-Win for ALL Stakeholders”

Investment and Asset Optimization

A strong ESG proposition shows the foresight of the management and their capital allocation abilities towards more promising and sustainable opportunities.

Here’s why:

If a company uses energy-hungry plants and equipment, it’s going to cost more over the long run.

Companies find themselves having to play catch-up (laggards) when they aren’t proactive in meeting regulations. The world is heading towards sustainability and companies who don’t follow the trend may get caught by regulatory Bans or limitations.

“Let your portfolio reflect your best vision of the future”

- David Gardner

Summary

Look for companies with consistently high ROIC and the ability to Grow Revenues through innovation and creating new customer segments. It is a bonus if they exhibit ESG traits in a genuine manner. These are typically the kinds of companies that will compound over time and make stakeholders lots of money.